EL LICEO CAMPESTRE THOMAS DE IRIARTE es una institución educativa de carácter privado, mixto, de Calendario A, ubicada a solo media hora de Bogotá.

PILARES INSTITUCIONALES:

Noticias Liceo Campestre

ESPACIOS Y PROPUESTAS EDUCATIVAS

En el LCTI desarrollamos permanentemente espacios y propuestas educativas creadas exclusivamente para proporcionar a nuestros estudiantes, ambientes de aprendizaje que favorezcan su desarrollo académico y…

RANKING SABER 11

Gracias a nuestro gran trabajo, excelencia académica, y proyecto educativo, el Liceo Campestre Thomas de Iriarte, sigue estando a la vanguardia y es considerada una…

“UN AÑO MAS JUNTOS EN NUESTRO COLEGIO”

Nuevamente juntos jugando, disfrutando y compartiendo en nuestro bello Colegio. Actividades como el Saint Valentine´s Day realizada el 14 de febrero, fortalecen nuestro dominio en…

CELEBRAMOS EL SAINT VALENTINE’S DAY

Buscando día a día fortalecer las habilidades propias del área de inglés, el pasado 14 de febrero celebramos el Saint Valentine’s Day, donde los estudiantes…

“CELEBRANDO NUESTRO DÍA DE LA RAZA”

El pasado 22 de Octubre celebramos en nuestro Liceo el día de la raza con una significativa puesta en escena cultural, donde la danza, la…

VISITA UNIVERSIDAD DEL ROSARIO Y LA SABANA

Las universidades del Rosario y de la sabana visitaron a nuestros compañeros de los grados superiores, y los invitaron a conocer las bondades económicas, que…

SEMILLERO DE THOMASITO

Nuestro hermoso semillero de Thomasito nos alegró con su visita, los compañeros de grado 11° fueron los encargados de hacerles el feliz recibimiento en nuestra…

DIA DE LA CIENCIA 2019

El día de la ciencia es todo un aprender para nosotros a través de los distintos proyectos que desde el área manejan. Aprendimos de compostaje,…

EVENTO ARTÍSTICO Y CULTURAL, EACT – 2019

Nuestro gran evento artístico y cultural, EACT – 2019 nos permitió mostrar los grandes dotes artísticos que nos han caracterizado siempre, en música coral e…

“COMPARTIENDO Y APRENDIENDO CADA DÍA”

Dentro de nuestras diversas actividades para este semestre hemos contado con la visita de la Universidad de la Sabana y el Café Literario, donde nuestros…

“VIVA LA DEMOCRACIA”

En nuestro colegio el poder elegir y ser elegido hace parte de nuestro quehacer institucional; por esto una vez más, este año todos juntos vivimos…

“NUESTRAS ACTIVIDADES ESCOLARES”

En mi colegio siempre estamos complementando nuestro quehacer académico con distintas actividades que nos permiten disfrutar y gozar de la vida escolar. Las convivencias fortalecen…

“HUERTA UN ESPACIO PARA APRENDER”

Todos juntos trabajamos en la huerta escolar; los compañeros grandes hacen semilleros y nosotros, los pequeños, sembramos las plantas. Después todos juntos cuidamos, regamos y…

“NUESTRAS ACTIVIDADES Y CAMPAÑAS”

Dentro de nuestro cronograma de trabajo anual, al momento hemos ya cumplido con campañas tan importantes como el manejo responsable de redes sociales direccionado por…

“CONVIVIENDO EN MI COLEGIO”

A la fecha han pasado ya varias semanas y nuevamente estoy feliz en mi hermoso colegio. Compartiendo con mis amigos, aprendiendo con mis profesores y…

FUNDACIÓN ANGELES DEL CAMPO

Nuestro Liceo visitó la Fundación angeles del campo, compartimos un día lleno de alegría, regalos y la gran satisfacción de ver en sus rostros sonrisas…

CRUCE DE BANDERAS 2018

Los estudiantes de grado 11, en un acto cívico hicieron la entrega de banderas a los estudiantes de grado 10, quienes continuarán llevando en alto…

DESPEDIDA ESTUDIANTES THOMASINOS

En una emotiva despedida a nuestros estudiantes thomasinos, celebramos sus triunfos, logros y reconocimientos obtenidos. Cuando llega el fin de año, pensamos en todas las…

CAMPAMENTO PROMOCIÓN 2018

Ningún soñador es pequeño y ningún sueño es demasiado grande. #soythomasino

¡CELEBRACIÓN DÍA DE LOS NIÑOS!

Porque se vale reír, divertirse y soñar nuestros niños y jovenes disfrutaron de un alegre y dulce día. “La alegría y el amor son dos…

PRIMERAS COMUNIÓNES

La Primera Comunión es sin duda, un momento muy importante en la vida de los niños y sus familias. Motivo por el cual los felicitamos…

FESTIVAL DE ORATORIA Y LITERATURA 2018

Con mucho compromiso nuestros estudiantes thomasinos asumieron el rol de oradores, desarrollando así su expresividad y tomando una posición crítica a través del análisis de…

GRAN CONCURSO DE DEBATE

Felicitamos a nuestros estudiantes de Grado Once, quienes ocuparon el II Puesto entre varios colegios en el Gran Concurso de Debate que organizó la Facultad…

¡ENGLISH WEEK!

Nuestros estudiantes tuvieron un acercamiento significativo a la investigación en el aula . Se realizaron diferentes actividades del proyecto síntesis que se trabaja en la…

NUESTRO MULTIDIA!

Un poco mas de nuestro Multidía. Además de la inauguración de nuestra granja y huerta , nuestros estudiantes thomasinos disfrutaron de un día lleno de…

¡INAUGURACIÓN GRANJA THOMASINA¡

Nuestros estudiantes disfrutaron de la nueva granja y huerta, un gran espacio verde y enriquecedor. Una oportunidad única para descubrir por sí mismos el medio…

CAMPAÑA GLOBAL CYBER DAY

Hoy nos unimos a la campaña GLOBAL CYBER DAY a nivel mundial, donde los profesionales del equipo de Ciberseguridad de KPMG , impartieron lecciones de…

CAMINATA ECOLÓGICA

De caminata ecológica por el bosque alto andino que se ubica en la zona media , ladera las montañas que rodean nuestro Liceo . Un…

VALOR DE LA SOLIDARIDAD

El Liceo Campestre promovió en el mes de agosto el valor de la SOLIDARIDAD, nuestros estudiantes vivenciaron de forma práctica y significativa este gran valor…

EVENTO CULTURAL Y ARTISTICO 2018

El pasado 05 de agosto nuestros estudiantes presentaron un majestuoso y colorido evento artístico y cultural, una puesta en escena que pintó los colores de…

EVENTO CULTURAL Y ARTISTICO 2018

El pasado 05 de agosto nuestros estudiantes presentaron un majestuoso y colorido evento artístico y cultural, una puesta en escena que pintó los colores de…

ESTUDIANTES CICLO II – EXPOSICION

En días pasados nuestros estudiantes de Ciclo II, expusieron una muestra fotográfica luego de haber realizado un curso en clases. Los trabajos fueron excelentes y…

GRITO DE LA INDEPENDENCIA- 20 DE JULIO

Nuestros estudiantes en cabeza del Departamento de Ciencias Sociales, celebraron nuestra identidad nacional compartiendo con toda la comunidad educativa la conmemoración número 208 del GRITO…

¡LA CÁPSULA DEL TIEMPO!

El pasado 13 de Julio los estudiantes de grado quinto bajo la dirección del Docente David Rodriguez (tecnología) , materializaron el proyecto ¡LA CÁPSULA DEL…

“DIA E de la Familia y Estudiantes”

DIA E de la Familia y estudiantes. En nuestro Liceo vivimos una jornada de sensibilización y reflexión. Resaltamos la participación activa y el acompañamiento responsable…

“COSECHA AUTOSOSTENIBLE”

¡Hoy presentamos la primera cosecha de nuestra huerta autosostenible! Los estudiantes han hecho parte fundamental en la práctica del cultivo. De forma comprometida y a…

LABORATORIO DE CIENCIAS NATURALES

Nuestro laboratorio de Ciencias Naturales , un espacio donde los estudiantes se interesan por conocer, experimentar, abren paso a la curiosidad y llevan a la…

DÍA E | NUESTRA RUTA ES LA EXCELENCIA EDUCATIVA

Siguiendo firmes en la ruta hacia la excelencia educativa , nuestros docentes y directivas del Liceo , realizaron el ‘Día E’ decretado por el Ministerio…

“ETNO BOTANICA INFANTIL”

Dentro del proyecto ambiental del Liceo y del proyecto síntesis “Etno Botanica Infantil ” Se dio inicio al trabajo en nuestra huerta escolar donde nuestros…

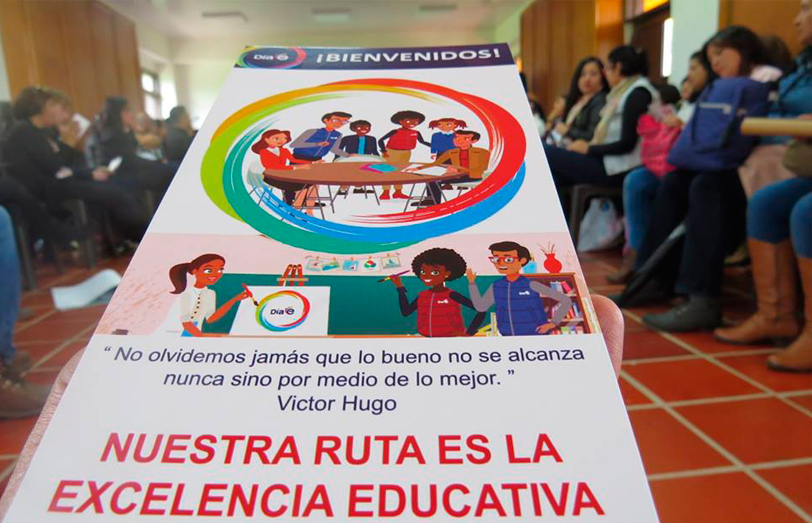

1a EXPOSICIÓN “TÉCNICAS ARTÍSTICAS”

Nuestros estudiantes de ciclo 1 tuvieron la oportunidad de dar a conocer las primeras evidencias de su proceso en artes plásticas, en la 1a exposición…

“SOY UN BUEN PEATÓN”

El Liceo en cabeza del área de Ciencias Sociales y los estudiantes de grado tercero de Ciclo I, realizaron la campaña “SOY UN BUEN PEATÓN”…

CONCIENCIA AMBIENTAL

En nuestro Liceo celebramos la vida y el amor por la madre tierra , por ello los invitamos a reflexionar sobre nuestro papel en el…

XVII MODELO DE NACIONES UNIDAS

El Liceo Campestre fue invitado a participar en el XVII Modelo de Naciones Unidas, realizado en el colegio Mayor de los Andes, evento en que…

CELEBRACIÓN DÍA DEL IDIOMA

Hoy nuestro Liceo en cabeza del área de español , celebra el DIA DEL IDIOMA en memoria de Miguel de Cervantes Saavedra y Homenaje a…

CIBER-ESCUELA DE PADRES

El departamento de Psico-orientación quiere hacer extensa su invitación a participar de la ciber-escuela de padres que da inicio este año con dos novedosos artículos,…

GOBIERNO ESCOLAR ELECTO

Posesión de los integrantes del Gobierno escolar electo. La democracia se lleva a cabo mediante una verdadera participación, esto solo se logra cuando existe un…

NUESTRA COMUNIDAD SE ENORGULLECE Y CELEBRA CONVENIO 2018-2021

Nuestra comunidad se ENORGULLECE Y CELEBRA la renovación del convenio 2018-2021 emitido por la Universidad de Cambridge (Inglaterra,UK) en donde continuamos en el proceso de…

GOBIERNO ESCOLAR

El Liceo vivió una fiesta por la democracia con las elecciones escolares 2018 con la dirección y acompañamiento del departamento de Ciencias Sociales. JOVENES POR…

¡INAGURACION DE JUEGOS INTERCURSOS!

En nuestro Liceo somos semillas de paz , con la practica de una sana competencia y juego limpio. #soythomasino

EXPOSITORES DE CICLO I

Nuestros pequeños expositores de ciclo I, con grandes consejos a nuestros padres de familia en la pasada Asamblea General. No cabe duda de que hay…

GANADORES DISEÑO DEL SUPER HÉROE

Presentamos a nuestros ganadores del diseño del super héroe y eslogan de la campaña para la convivencia escolar del Buen trato. FELICITACIONES #psicorientacion #soythomasino …

CEREMONIA PRUEBAS CAMBRIGDE 2017

Todos los años nuestros estudiantes certifican su excelente desempeño y avances en las pruebas internacionales cambrigde FELICITACIONES #soythomasino

CAMPAÑA DE CONVIVENCIA ESCOLAR CICLO I

El lanzamiento de la campaña para la convivencia escolar ciclo I. ¡SOMOS SUPER HÉROES POR EL BUEN TRATO! #soythomasino

CAMPAÑA PARA LA CONVIVENCIA ESCOLAR

Nuestros estudiantes de Ciclo II participaron activamente en nuestra campaña para la convivencia escolar ¡La diferencia nos enriquece, hagamos un trato por el el buen…

BIENVENIDA A NUESTROS ESTUDIANTES THOMASINOS

Hoy nuestras aulas y pasillos se llenan de vida y de alegría, damos la bienvenida a nuestros estudiantes Thomasinos , ellos son el alma de…

Plataformas

Solidaridad y Apoyo

Solidaridad y Apoyo  Atención y Prevención

Atención y Prevención  Psico-Orientación

Psico-Orientación Convivencias y campamentos

Convivencias y campamentos  Liderazgo y Democracia

Liderazgo y Democracia